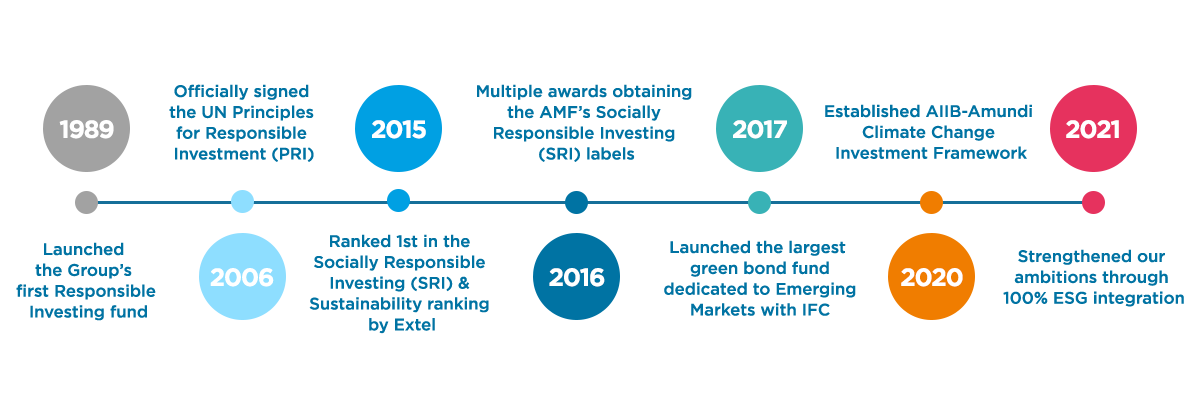

Sustainable investing is part of our heritage. Environmental, Social, and Governance (ESG) factors have been a core element of our research process and play a key role in investment decisions across our actively managed investment strategies.

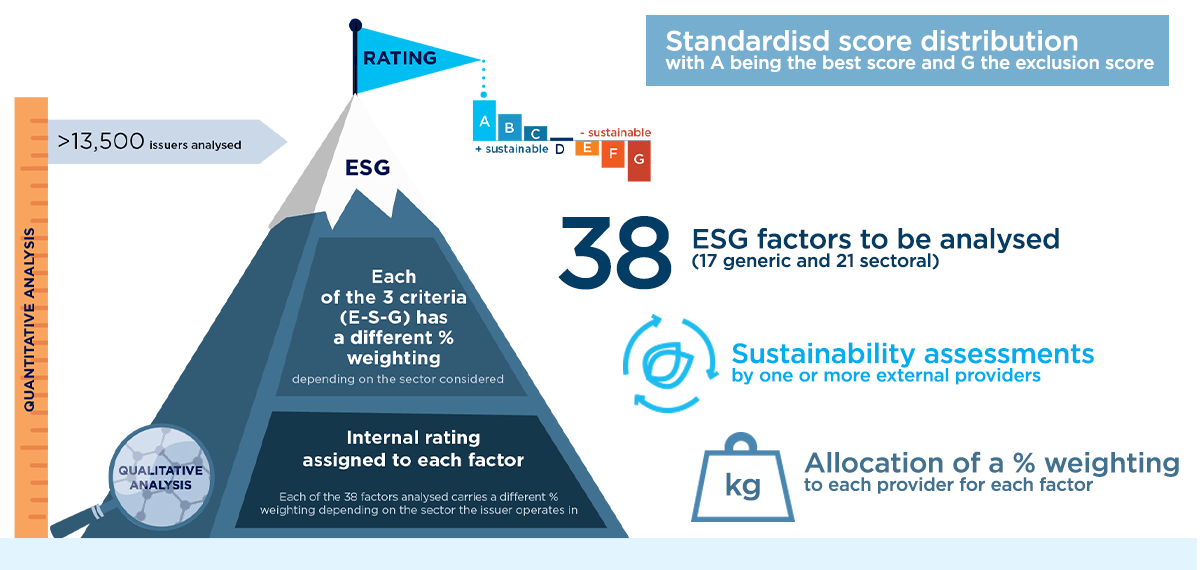

We integrate ESG analysis into its investment process by focusing on companies with sustainable business models and evaluating ESG-related risks as part of our proprietary research recommendations used throughout the firm.